Understanding how the accounting equation works is one of the most important accounting skills for beginners because everything we do in accounting is somehow connected to it.

In this lesson, I explain all you need to know about the accounting equation in the most simple way possible. Once you’ve mastered the accounting equation, do solve the quiz given at the end of the lesson to test your understanding!

The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity. For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K).

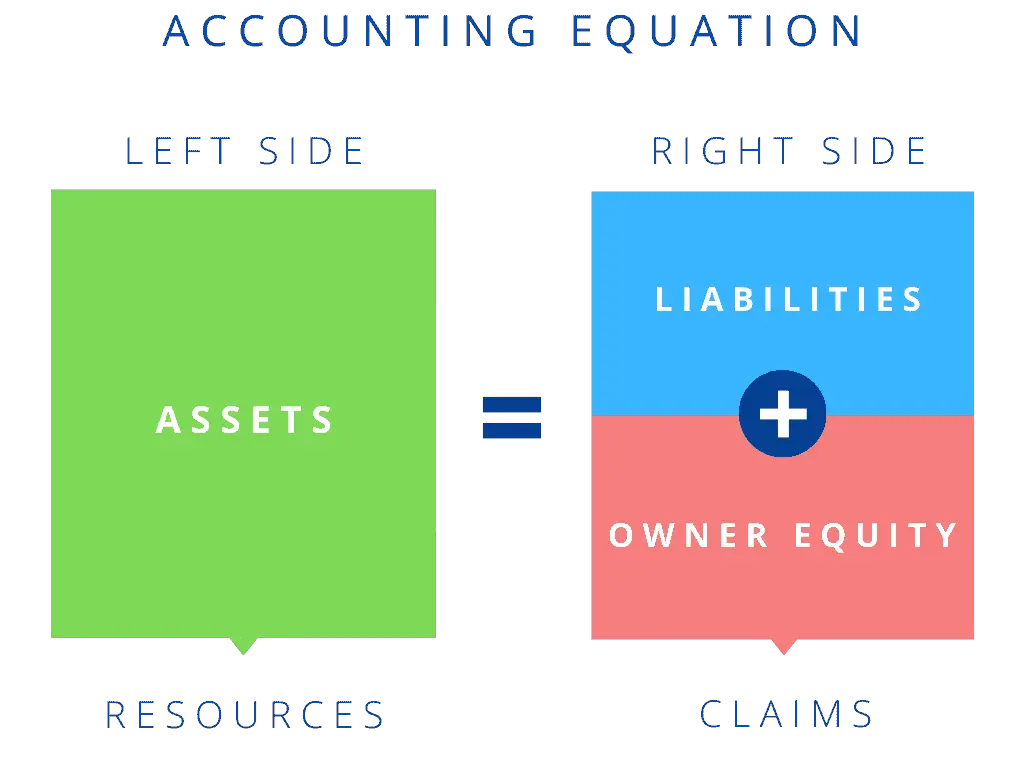

The accounting equation shows the amount of resources available to a business on the left side (Assets) and those who have a claim on those resources on the right side (Liabilities + Equity). Both sides of the accounting equation are always equal.

Before explaining what this means and why the accounting equation should always balance , let’s review the meaning of the terms assets , liabilities, and owners’ equity .

Assets are the physical, monetary, and non-physical properties owned or controlled by a business such cash, machinery, buildings, inventory, and websites that help generate income for the business.

LiabilitiesLiabilities are the financial obligations that a business owes to creditors, such as accounts payables owed to suppliers for goods received on credit.

Owner's EquityOwner's equity is the net assets that are contributed by the owners of a business in the form of capital contributions and accumulated profits that are retained in the business. It is basically what's left in the business for the owners after all liabilities are paid off.

Although the amounts of assets, liabilities, and owner's equity frequently change in a business because of transactions, the total assets always match the sum of liabilities and owner's equity because the owner's equity acts as the balancing amount in the accounting equation.

The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity).

The owner’s equity is the balancing amount in the accounting equation. So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance.

Mathematics aside, if we simply consider the fact that without any investment by owners (equity) and debt borrowed from creditors (liabilities), a business would have absolutely no resources. This implies that all assets that exist in the business must have been acquired from either:

Since a business has nothing to begin with when it is first formed, the amount of assets in a business should always match the amount borrowed from creditors (liability), capital investment by owners (owner's equity), and retained profits (owner's equity).

If you’re still unsure why the accounting equation just has to balance, the following example shows how the accounting equation remains in balance even after the effects of several transactions are accounted for.

Laura wants to turn her passion for yoga into her career by starting a yoga coaching business.

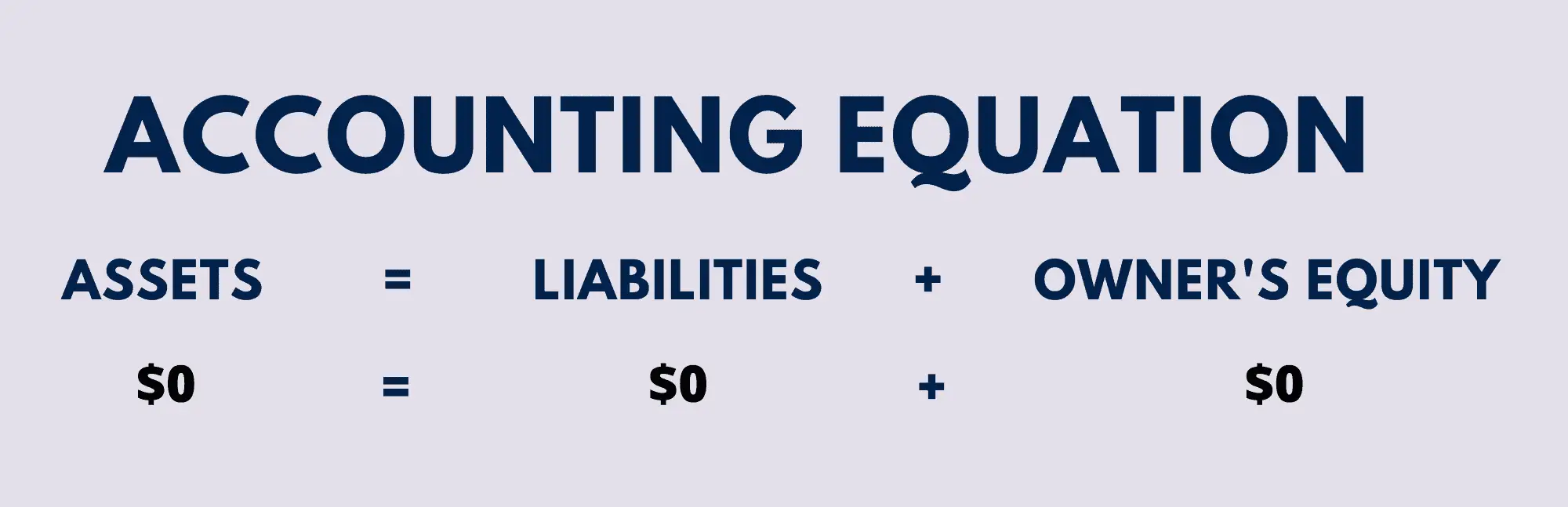

Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides.

In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business.

The following transactions took place on the first day of business:

Following transactions happened during the rest of the month:

To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business.

Here’s an explanation of how the values listed above have been calculated.

This is how the accounting equation of Laura’s business looks like after incorporating the effects of all transactions at the end of month 1.

As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved.